One of the most inherited forms of movable assets is jewellery. It can be inherited gold jewellery sets passed down as the family heirloom or a solitaire gifted by your beloved on your special days. Jewellery articles are everybody’s prized possession be it financially or emotionally. Everybody has their sentiments attached to it. To take care of their jewellery one stays cautious all the time. The value of our jewellery is worth the weight in gold, literally!

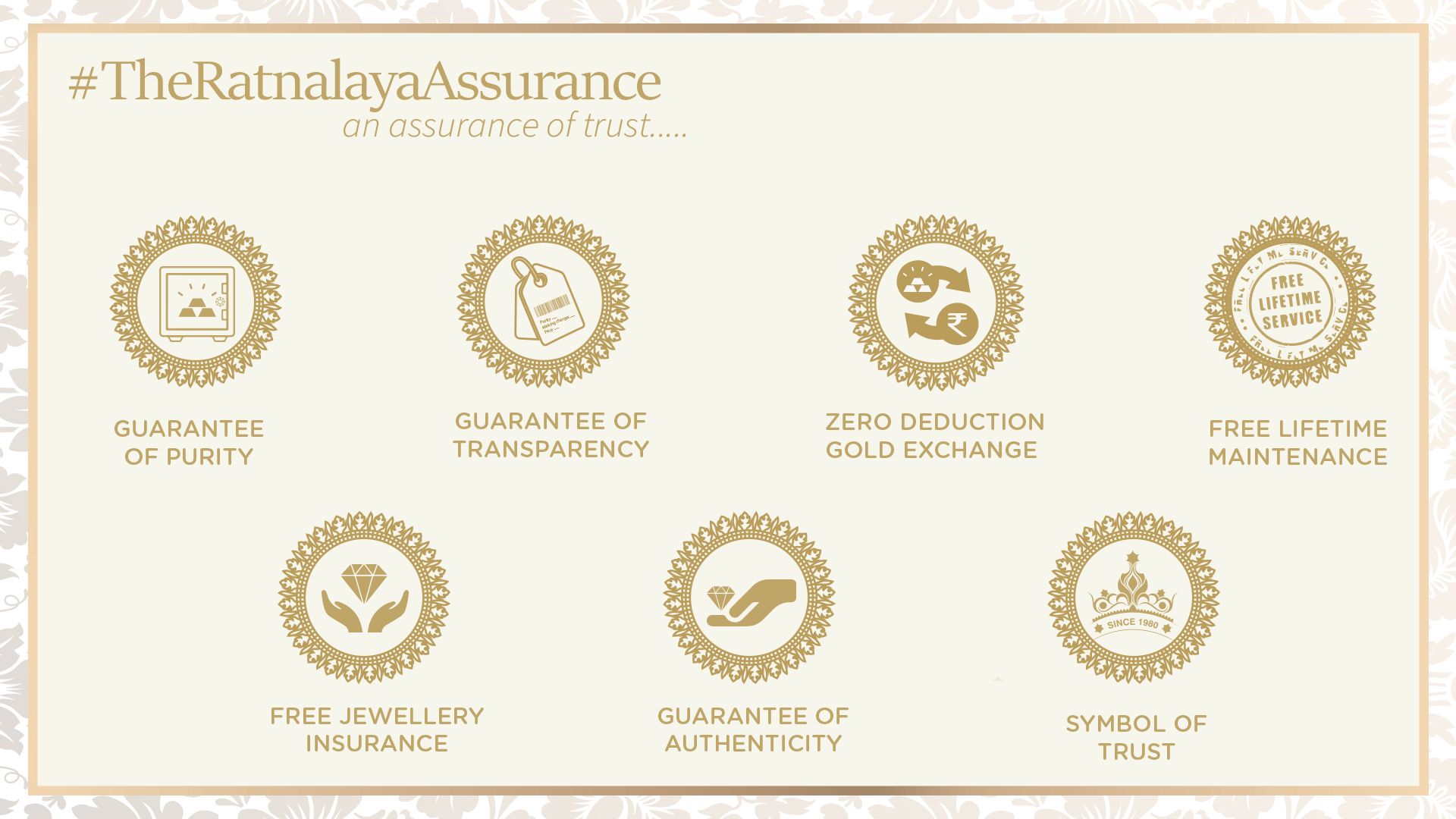

With Ratnalaya’s jewellery insurance policy, your most precious possession is covered.

Safeguarding your jewellery is a must. To keep your precious and most loved jewellery in safe hands, one cannot trust bank lockers anymore as they do not guarantee its safety. With the RBI saying, “banks have no liability for loss of valuables in lockers”, it becomes evident.

Ratnalaya Jewellers’ insurance policy is always a good idea when it comes to securing your jewellery. There can be a lot of scenarios and unforeseen circumstances which are beyond our control. The answer to every doubt is insurance. With Ratnalaya’s Insurance policy you can wear your pride freely with peace of mind.

Ratnalaya guarantees you one-year free jewellery insurance on the day of purchase itself, be it gold or heavily stone studded jewellery articles. We got your back. We understand how important they are for you. This preciousness has an untold story behind them and we understand how emotionally attached you are to it. At Ratnalaya, we respect that connection. We not just keep in mind the market condition and rising gold prices but also the hard work behind earning a single piece of it. To secure your riches we offer free insurance to all our customers.

These insurance policies cover loss due to fire and allied perils, natural calamities such as earthquake, flood etc. It is inclusive of riots, strikes, theft as snatching, robbery, dacoity, housebreaking or burglary. The jewellery articles are also secure of any damage due to accident, terrorism, loss from above while in transit within India.

However, it excludes loss from falling/ dropping of jewellery or stones from jewellery; loss due to unexplained/ mysterious disappearance; loss sustained while repairing or cleaning; loss of or loss to the jewellery if forgotten or left in an unoccupied vehicle; loss due to willful act, neglect, dishonesty; loss due to wear and tear; loss due to act of government, a public or local authority like confiscation, detention etc.

Jewellery owners are in constant risk of being robbed or losing their hard-earned pieces of jewellery. Hence, it is crucial to shield your riches and save yourself from the crisis.